Earlier this year, Fathom launched its new flood model for the UK. The flood hazard data and catastrophe model combines a precise representation of every river channel in the UK with terrain data, multiple perils and defence algorithms to create a detailed and realistic representation of flood risk.

With extreme flood events in the UK intensifying due to global warming, technologies that help us to understand risk are more important than ever. The development of Catastrophe models for flood has recently accelerated due to new methodologies and the availability of new datasets. Even in the last year, we have seen a greater ability to represent functions like flood defences, vulnerabilities and climate change over different time horizons. Now an essential tool, catastrophe models have become a must-have to accurately quantify the financial value of flood risk.

At the start of 2021, global flood specialists Fathom released their latest flood hazard data and catastrophe model for the UK. Now available on the Oasis Loss Modelling Framework, we take a look at some of the unique functionalities underpinning the model, and how these can support the insurance sector.

Technical specifications

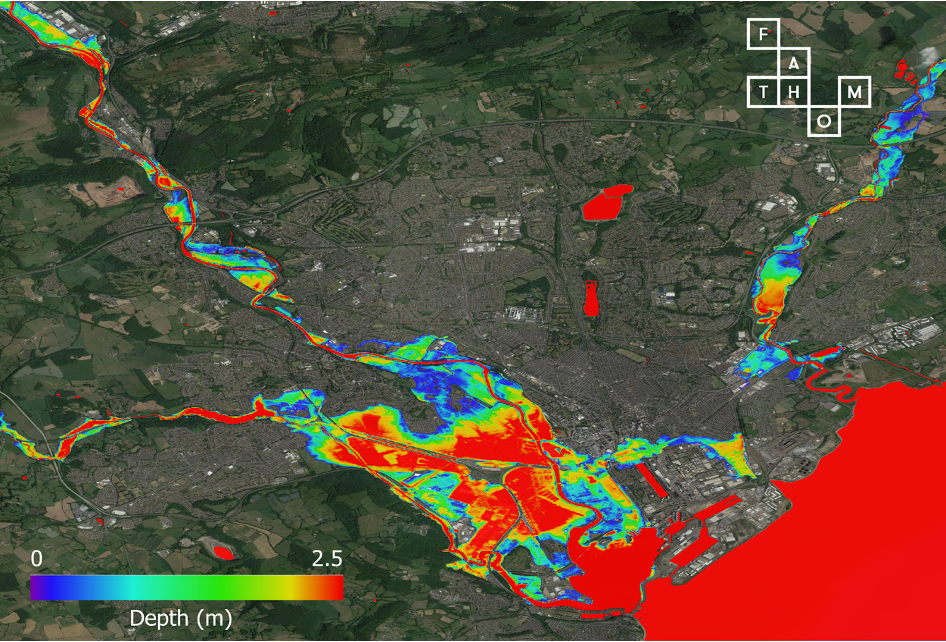

Fathom-UK CAT covers 100% of rivers in the UK regardless of size, utilising a river gauge-based approach which enables it to represent high frequency flood events (1 in 5 years) with a level of detail previously unseen in the industry. By pairing this with a representation of over 170,000 synthetic flood events the model can calculate potential losses for Insurers, incorporating the effects of long or short duration flooding. This enables Insurers to distinguish between the damages that properties will experience due to higher frequency shorter duration flooding and, less frequent yet more extreme, longer duration flooding.

This is particularly important in areas more prone to flooding such as Wales and Cornwall. With extreme precipitation expected to intensify across the UK due to climate change, it is important that we calculate and price coverage correctly so that property owners are protected.

Extreme fluvial event, Cardiff.

Practically applying vulnerability functions

One of the model’s unique strengths is its ability to accurately determine damages based on a building’s characteristics. Containing >10,000 damage functions, Fathom-UK CAT is able to differentiate building and coverage types such as residential, commercial and industrial buildings – for direct (e.g., structural and contents) and indirect (e.g., ALE and BI) damages.

This is ideal for Underwriters looking to accurately price policies that represent the real risk posed - rather than generalised coverage.

Furthermore, users of the model can identify different types of non-residential buildings, such as gyms, hotels and hospitals, and simulate the impact of business interruption. This is a hugely important feature for Commercial Insurers and where building data is absent, our model can generalise this information.

With all of these enhanced functions, Catastrophe Modellers and Underwriters are provided with an unparalleled understanding of flood risk. Through leveraging the catastrophe model, insurance businesses can provide a much more specific and precise estimation of risk; which is a real competitive advantage in a crowded market.

Next steps for the model

Having been developed in tandem with our flood hazard data, the model has received a lot of traction due to its ability to incorporate predictions for multiple climate scenarios from the present day through to 2030, 2050 and 2070. This is done by combining a climate model output from the Met Office UKCP18 dataset with a number of concentration pathways and temperature rise scenarios.

As we continue to improve our models, we will be incorporating these climate scenarios in our catastrophe model in an upcoming update. With no model on the market able to offer this form of analysis, this will be key for the financial sector who are looking to better understand how flood risk will change in the future.

Find out more

For anyone who is interested in the model, they can visit Fathom’s website or get in touch here.