Open Data Standards (ODS) are key to ensuring continued transparency and are fundamental to improving interoperability that will increase efficiency for the market, reduce costs, and enable greater choice in the use of catastrophe models.

The OED (Open Exposure Data) Standard arose from the lack of an industry standard for Oasis LMF-based models. Both OED and ORD were intended to assist with solving interoperability problems current in the insurance market, where implementing a model-developer-independent exposure data and results repositories will assist in creating more choice in the use of catastrophe models and analytical tools.

The ORD (Open Results Data) Standard was developed as a result of a collaborative project involving Managing Agents, Brokers, (Re)Insurance companies, Risk Modelling Vendors, and Third-Party Providers during the Lloyd’s of London Cohort 3 Innovation Lab in Q’s 3/4, 2019.

To continue to allow for the evolution of OED and ORD, and adoption by the (re)insurance market, a Steering Committee - formed of industry experts - will agree on the governance and curation of both standards in the future. The SteerCo agreed to the name Open Data Standards (ODS) to capture the full remit of the initiative.

The latest data specification for OED v3 can be accessed HERE

SHORT CLIPS - What does the community have to say?

1: Definitions, Value and Approaches of Open Data Standards

Speaker:

Gavin Starks, Founder - Icebreaker One

Gavin discusses the definitions and value of ‘open data’ and specifically uses the ‘Open Banking Standard’ as an example. Gavin highlights the requirements and approach when developing an open standard and one thing is clear; regardless of market, or sector, collaboration is key.

https://www.youtube.com/watch?v=y9fLciRK8xQ&list=PLS9B14JFDHoRP6H33YjGHn2IxuwGE2fX9&index=2

2. The Importance of Open Data Standards for the Insurance and Cat Modelling Community

Speakers:

Ian Branagan, Executive Vice President and Group Chief Risk Officer - RenaissanceRe Holdings Ltd.

Stephen Hutchings, Head of Modelling - JBA Risk Management (0:37)

William Forde, Senior Director - CoreLogic (1:42)

This film highlights the current inefficiencies and limitations with sharing and accessing data within the cat modelling community and insurance market. All three speakers discuss the importance of having an open data standard in the market-place and the significant benefits it will bring to the user.

https://www.youtube.com/watch?v=utD-meLbF0o&list=PLS9B14JFDHoRP6H33YjGHn2IxuwGE2fX9&index=3

3. The Development of the Open Exposure Data (OED) format

Speakers:

Matthew Jones, Head of Catastrophe Risk - Nasdaq

Aiste Kalinauskaite, Senior Insurance Product Specialist - Nasdaq

This film highlights the details around the need and development of the OED format which began in 2018. OED is the model agnostic, data format used for exposure data when running models on the Oasis Platform.

https://www.youtube.com/watch?v=OBjbVLIkMEE&list=PLS9B14JFDHoRP6H33YjGHn2IxuwGE2fX9&index=4

4. The Considerations and Comparisons with Proprietary formats

Speaker:

Mark Cravens, Principal - Cravens Consulting

Mark Cravens gives an extensive view of the considerations required when using data standards and how it compares to proprietary formats current in the cat modelling community.

https://www.youtube.com/watch?v=J0iu32M9G4E

Keep updated on ODS developments and implementations

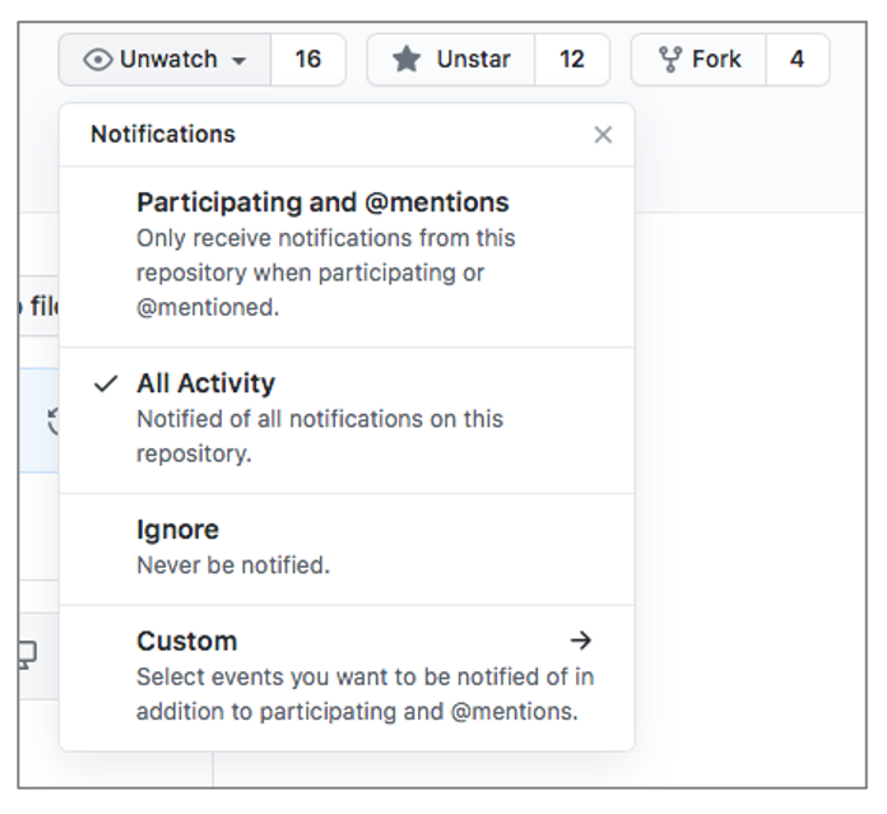

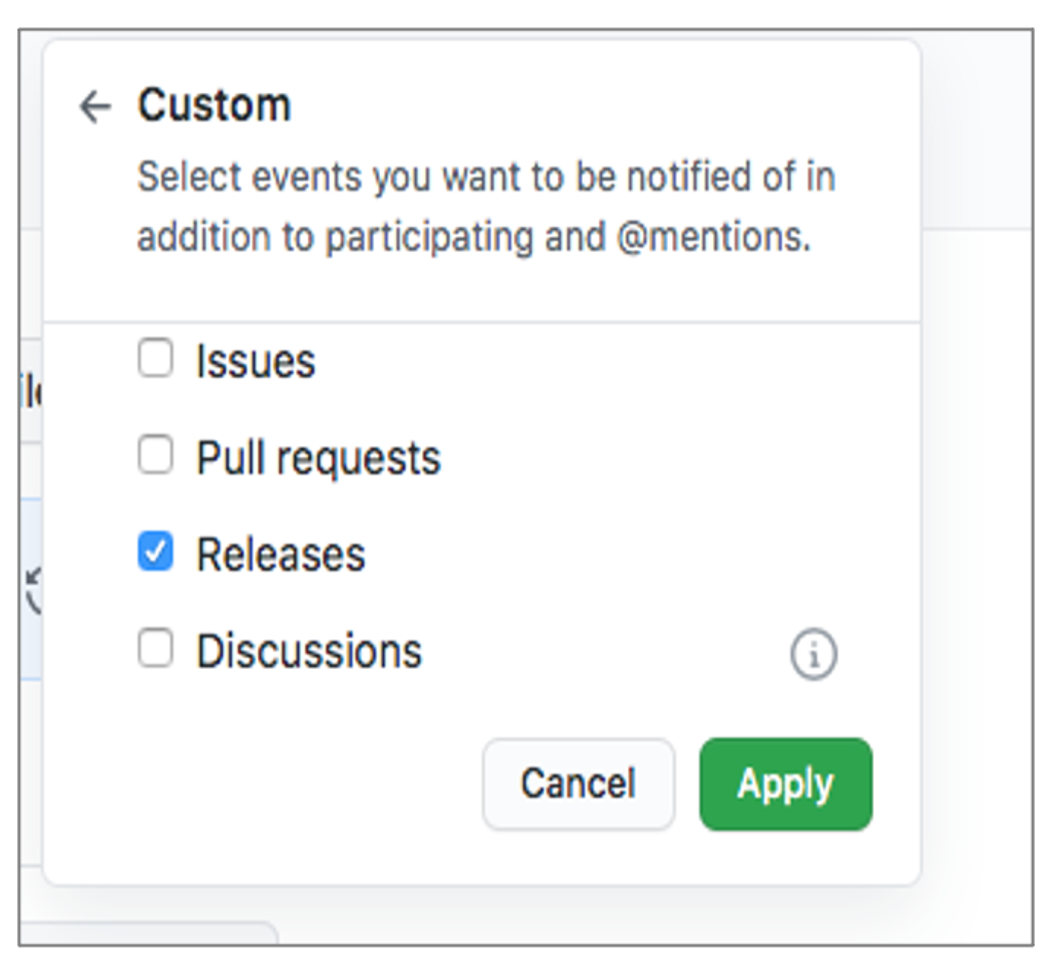

To keep updated on ODS developments and implementations, we recommend you ‘watch’ the ODS GitHub repository by selecting this option in the top right corner of the repository. This will ensure you receive email notifications of any changes made in the repository, which can be customised to limit what notifications you receive.

For the general user, we recommend ticking the “Releases” box, which will notify you when a new version of ODS has been released.

ODS for Liability

The open data standard for a first version of a liability schema was released on the 7th April 2022 and the recording of the market launch event can be found here.

Documentation and details around the schema can be found on the GitHub repository. It is completely free and open to anyone to download and to start using it.

ODS for Cyber

The open data standard for cyber was released on 9th Febraury 2023 and the recording of that market launch event can be found here. The documentation can also be found on the Github repository.

FAQs

What is ODS?

Open Data Standards (ODS) is a framework for open and transparent data sharing that will assist in addressing interoperability challenges in the insurance market. Implementing model-developer and model-vendor agnostic exposure data and results repositories will assist in creating choice and consistency in risk management applications.

Why is ODS important and what are the main benefits?

Having one consistent, community-owned data standard across the market has huge benefits, especially when it comes to data transfer between users of multiple models and systems. This will significantly reduce the huge drain on time and resource when it comes to data processing and formatting.

Being open is key to improving efficiency and transparency which will support collaboration, development and adoption.

Who is ODS for?

ODS can be used by anyone. Its completely open and free to access and anyone can contribute to its development.

How is ODS governed?

ODS is governed by a steering committee (SC) made up of attendees from multiple companies within the insurance sector such as insurers, reinsurers, cat model vendors, brokers and technology companies. The SC meets about four times a year and is currently chaired and curated by Oasis LMF.

Its agreed that ODS should not be owned by one particular company or entity for specific commercial gain and is currently only being ‘looked after’ by Oasis LMF. This will likely change in the coming years. ODS is a market initiative which will rely on wide collaboration from the market to develop and progress.

What are the main challenges of adopting ODS?

There are many challenges with adopting ODS but the two main and obvious ones are:

1) changing the mindset and practices of a marketplace that has relied on dominant proprietary formats for decades. Altering existing practices can be disruptive and require extra resource which is the biggest hurdle. Inertia will decrease as large users in the market (especially brokers) start to adopt ODS and include this standard as a format during renewals. ODS also needs supporting by regulators.

2) Agreeing the most appropriate and efficient technology for an open standard. It must be flexible, fit for purpose and easily accessible to the wider user base.

What are the mandatory fields used in OED?

The majority of mandatory fields in OED are model specific and so it will be up to the vendor of that model to supply these in their documentation and guidance. However, there are a handful of mandatory fields required to run a basic model in Oasis to produce the ground-up or economic losses.

All required or optional fields can be found in the ‘Open Exposure Data Spec’ doc on the GitHub repository below.

https://github.com/OasisLMF/OpenDataStandards/tree/master/OpenExposureData/Docs

What are the next steps for ODS?

The next steps on the ODS agenda for development are:

1. Develop the Open Data Transformation Framework (ODTF) so the free, open-source data mapping tool is available to transform data from multiple formats to OED and back. This should be available by end of 2023.

2. Expand the OED data schema further to support Marine as the next class of business. The aim is that this will be available by the end of Q1 2024.

3. Investigate and start the development of a claims data standard covering multiple classes, mainly property and cyber in the first instance.

Development of these next steps will be led and driven by specific working groups made up of market participants.

What are the long-term goals for ODS?

The long-term goal for ODS is that it becomes “the” market standard for catastrophe risk data and significantly improves data transfer across the market.

The aim is that ODS is a complete standard package, not just limited to cat risk data but to encompass multiple standards for messaging, interoperability and contract definition language.

Where can I find details and documentation on ODS?

All documentation on ODS and its governance are accessible to anyone on the following GitHub repository.